How to fundraise, fast.

Regardless of stage, raising capital from VCs and other investors is one of the most time-consuming, and often soul-destroying experiences. Getting our docs and strategy in place is essential to keeping the process efficient!

Preparation

Before starting to reach out to any investors it's important to have all fundraising materials ready to go. Delivering a successful pitch and then having to go back and put together a financial plan from scratch. Rightly or wrongly, investors will treat a delay in providing data as a negative signal.

Every startup should have the following ready to go:

- Pitch Deck or Investment Memo — pitch deck is the standard, but a concise investment memo can be a differentiator.

- Financial Plan — start with the main drivers for our startup and use this to create projections on a monthly basis for 3-5 years. The top line should show ambition, but based on some assumptions we can back up with data.

- Investor FAQs — discussed below, a nice hack to reduce the number of times your have to answer the same questions!

- Cap Table — investors want to check that the founders still own a meaningful stake in the startup, at Seed this should be >60%.

Depending on the type of business then it's often useful to have:

- Sales Pipeline — what's the value of the pipeline? Based on current data, what's "weighted" value (probability of closing x contract value).

- Cohort Analysis — essential for most startups with more than 6 months operating data, this gives a deep insight into our customer behaviour.

- Product Roadmap — what are the priority features, when will they be released? Often represented as a kanban or Gantt format.

- Product Demo — often useful to create a demo video on Loom or similar or create a demo environment for investors.

- Intellectual Property — more for deep tech, what IP do you have and how is it protected.

Hopefully most of this information is readily available as this data is also essential to understand the health of our startup!

Put this all together and you have a "data room" that you can easily share with investors that want to dive deeper into the business without having to pull an all-nighter in Excel.

Treating the Fundraising Process Like Sales

Using the common analogy to view equity fundraising as selling your startup's equity, we can view the fundraising process as very similar to setting up a sales funnel.

Prospecting

Start with a list of target investors, there are plenty of lists online that allow you to quickly assemble a list of investors that may be interested in investing in your startup.

Once you have the longlist, start your initial qualification. Crafting a high impact cold email introducing your pre-seed hardware startup to a Series B software investor is a massive waste of your time!

- Stage — pre-Seed, Seed, Series A etc. Some investors will also specify additional criteria e.g. "the earliest stage we invest is post-product with early revenues".

- Sector — fintech, consumer, B2B SaaS; most investors will share their favourite sectors openly, if in doubt look at their portfolio.

- Geography — many investors won't invest outside of the US or Europe for example.

- Conflicts — good investors don't invest into multiple companies competing in the same space. If you spot a competitor in their portfolio it's recommended to disqualify this investor.

N.B. Outliers — Sometimes you may come across outliers in an investor's portfolio. For example, they say they only invest in B2B SaaS but you spot a B2C fintech. If you don't know the partners well i.e. you go for a beer every other month, it's likely to be a quick no.

Qualification

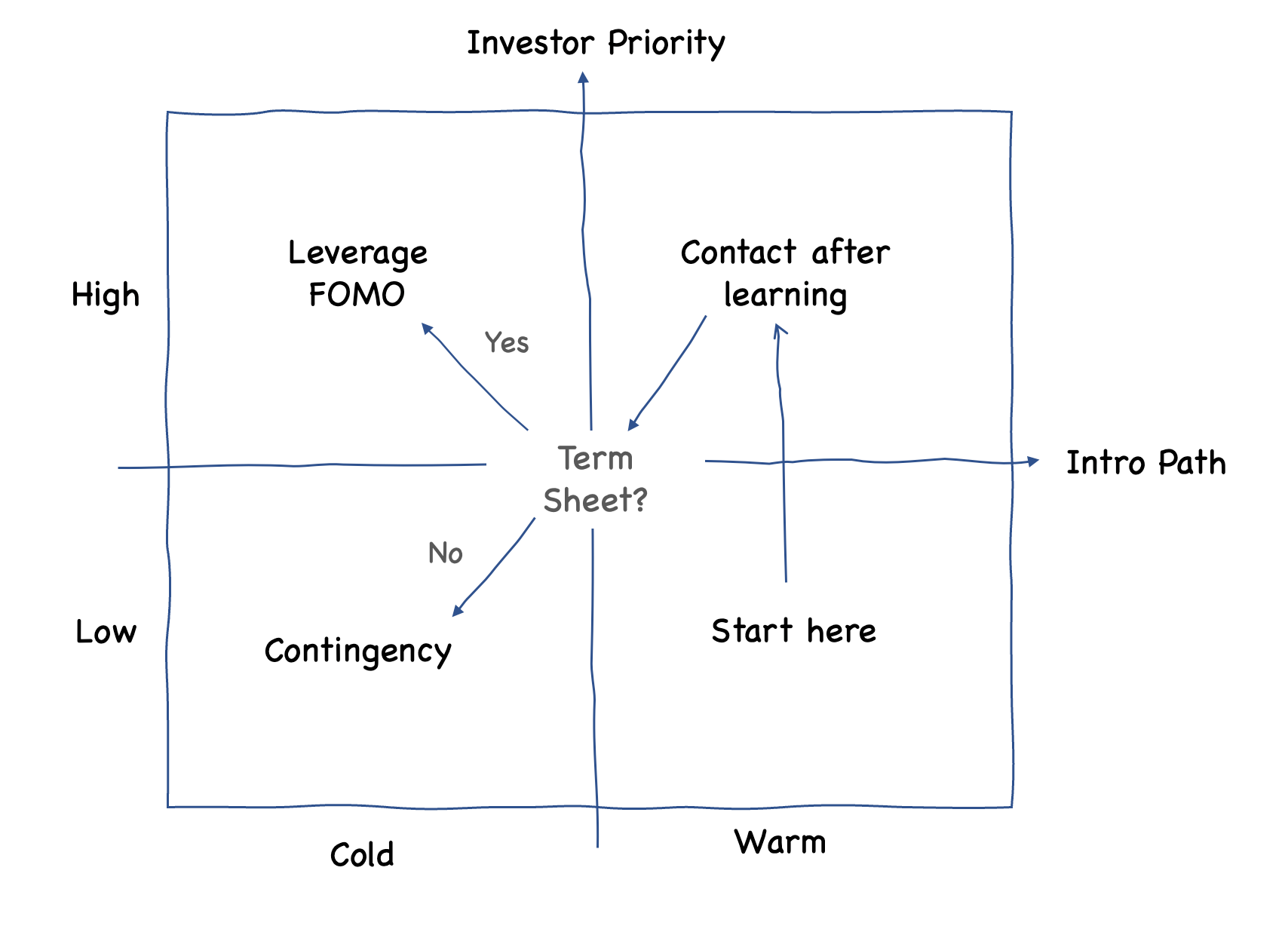

Now we have a hit list, we want to qualify along two dimensions

- Which investors we want the most?

- What level of access we have — warm or cold intro?

Now we can prioritise our outreach, as a rule of thumb you want to be in active conversation with 10 investors at any one time. As soon as someone passes, then add another into the mix.

Start with your low priority warm intros, leverage the learnings from those conversations and then move into high priority with warm intros. Hopefully at this point you have commitments and can create FOMO, if not you it's time to go to your contingency investors.

Don't Delegate

Fundraising should be run by the CEO. When closing funding is an existential risk for our startup, outsourcing the process to an employee or (even worse) a third-party is a red flag for most investors.

Focus on the raising the round, get it done and get back to building. Outsourcing the process will lower success rates and will end up taking more of our time.

Feedback Loop

We start with low-priority warm intros because we can access them quickly and either get a term sheet or feedback that will help us to improve our fundraising materials.

Whoever made the intro should also follow-up with the investor to get more candid feedback This is important as often major flaws in our pitch or concerns about the team won't be communicated.

Some founders may choose to A/B test the pitch, but realistically it's unlikely to gain enough data points to gain a significant advantage vs continuous feedback and improvement.

Armed with these learnings we can now go target our high priority investors with warm intros with a much higher chance of success.

Investor FAQ

It's frustrating to get the same questions asked several times, even more so when it's hundreds of times. This is very common during fundraising, as investors tend to have very similar concerns.

We can short circuit this by creating a frequently asked questions doc that you share with all investors as part of the data room. We then update this after every meeting with new questions and info, creating a comprehensive list of relevant Q&As for our target investors.

This both saves us time, but also makes us look very organised which investors tend to overindex for!

Creating FOMO

Investors are hype-driven, so the fastest fundraises also have a component of FOMO. Finn gives a better explanation than me, but essentially if you have a term sheet from another VC or they think the round is hot then it's possible to get commitments in a few weeks instead of months.

You can't really fake this (VCs all speak to each other), but the usually FOMO arrives from the following sources:

- Term sheet from strong investors

- Intro to a partner from a portfolio founder or angel they trust

- They overhear you pitching to a competitor fund at Soho House

For the first two bullets, these should be a early priority in the fundraise as they will both accelerate the process but also improve your negotiating position.

Following-up

Without any FOMO, there's often little incentive for investors to rush to commit unless it's July or November and holidays are imminent. Waiting an extra couple of months to see how the business improves, or declines, reduces risk.

Following up with investors is therefore essential to keep our startup top of mind, usually with an exciting new development. For example:

- We grew 20% this month

- We did a deeper dive into our customers and discovered this amazing cohort

- We received a term sheet

At the very least this should prompt a quicker no which means you can repeat the learning cycle and focus on other investors.

Fundraising Efficiently

Adopting this process should give us the most efficient pathway to fundraise for our startup, even if we have to go through many no's to get there. The key components for achieving this are:

- Prepare thoroughly

- Create a sales funnel and prioritise your outreach

- Create FOMO

Good luck!